Using clinical data to understand trends in outpatient care

Introduction

Outpatient care has skyrocketed in recent years—and is expected to grow still higher in the next decade. While inpatient care was once a primary revenue driver for many hospitals, it has not kept pace with the rapid growth of outpatient care. Driven by several factors, these shifts away from inpatient care require hospital leaders to assess how these changes will impact their bottom line.

Clinical data are especially valuable as hospital leaders navigate site-of-care shifts. These data hold the key to understanding what types of care patients are seeking externally and determining suitable care settings for patients’ needs. Additionally, because facilities will still need to collect and report high-quality clinical data for many registries, the need for high-integrity clinical data will remain paramount even in areas where changes are expected.

This white paper discusses the key drivers of site-of-care shifts, potential impacts, and the important role clinical data play throughout these changes. It presents market analytics data from Q-Centrix to demonstrate how clinical data can be used to identify patterns in site-of-care shifts. Finally, this paper shares considerations for hospital leaders as they prepare for the changes ahead.

Clinical data are especially valuable as hospital leaders navigate site-of-care shifts.

Key drivers

Medical advances

With the advent of new medications, treatment options, and minimally invasive surgical techniques, many services can be safely provided in an outpatient setting, reducing patients’ recovery time.

Regulatory changes

As CMS removes procedures from the inpatient-only list, opportunities arise for ambulatory surgery centers (ASCs) to provide more services. CMS recently removed 11 services from the inpatient-only list for 2023.

Lower costs

ASCs, a rising provider of outpatient care, lack hospitals’ overhead expenses and can offer services at lower costs—making ASCs attractive to insurers, providers (who are incentivized to give care in cost-effective settings), and patients.

COVID-19 pandemic

The pandemic likely accelerated the move to outpatient care by motivating patients to seek care outside of hospital settings.

Impacts

Disparate impacts by service line.

Some service lines will see major changes, while others will remain largely unaffected. Services most likely to move to outpatient include those in orthopedics, cardiology, and radiology.

Higher-risk patients using emergency and inpatient services.

With some patients turning to urgent care clinics and other non-hospital sites for emergency services, hospitals’ emergency departments may see a higher influx of sicker patients. An aging population and a rise in chronic diseases may result in a nine percent increase in inpatient stays.

Declining revenue.

A Deloitte analysis predicts that revenue for hospital-based services will decline by 21 percent by 2026. This amounts to approximately $207 billion in losses.

The continued importance of clinical data

Despite the varied impacts site-of-care shifts will have on hospitals and health systems, the need to collect, report, and review high-quality clinical data will remain a constant. Several registries—including those in cardiology, trauma, and surgical service lines—will be largely unaffected by site-of-care shifts. With registry participation a necessity for many types of reimbursements, quality improvement practices, national benchmarking, and more, hospitals will still need to collect and report clinical data for a variety of registries. These registries may include STS, Trauma, NSQIP, MBSAQIP, CathPCI, GWTG – Stroke, and GWTG – Heart Failure.

Data are also essential in guiding decisions related to site-of-care shifts. Health system executives have cited data as a valuable facilitator in making decisions about the most suitable care settings for patients. In fact, the next section of this white paper provides an example of how clinical data can be used to analyze shift patterns and care settings.

Clinical data in action: A closer look at shifts in oncology

To demonstrate how clinical data can be used to identify shift patterns in service lines, Q-Centrix reviewed oncology market analytics data from Q-Centrix partner facilities. It has been reported that many oncology services are expected to remain inpatient due to the type of treatment, duration, frequency, or level of support patients require. However, without a detailed, year-over-year analysis of patient activity at the procedure level, it is difficult for hospital leaders to determine when patients are most likely to seek external care and understand from historical trends what changes may lie ahead in the coming years.

These data, drawn from more than 50,000 unique patients, exemplify the value of turning to clinical data for deeper insights into site-of-care shifts. By reviewing clinical data on where patients are receiving care and the treatments they are most likely to seek externally, hospital leaders can make informed decisions about which resources they are most in need of and what services they can more effectively provide.

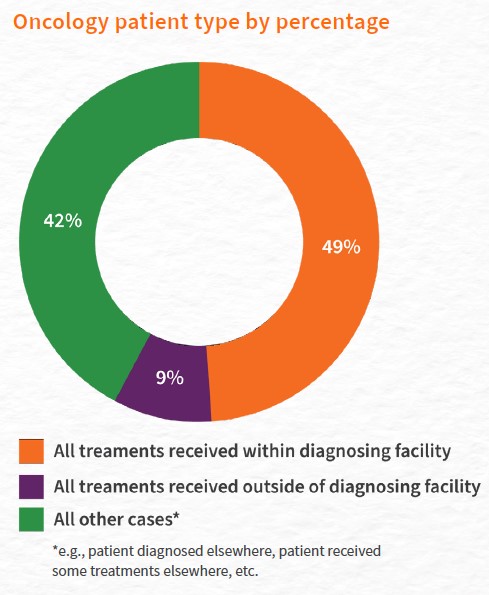

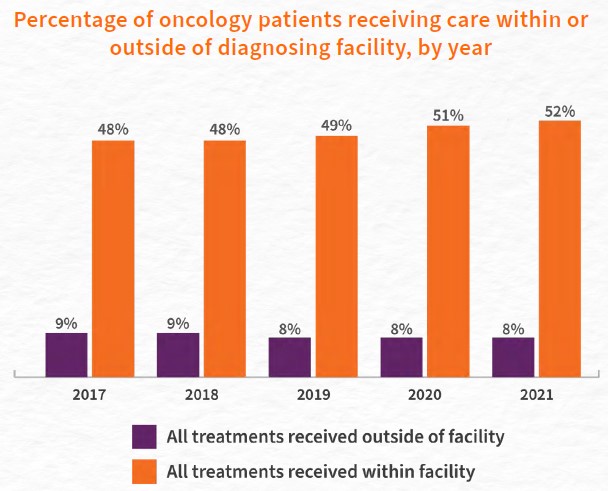

Patient types

Q-Centrix found that oncology patients who were diagnosed at a facility were most likely to stay at that facility for all subsequent treatment needs and medical decisions. On average across all years, nearly half of oncology patients (49 percent) chose to receive all treatments at the same facility where they were diagnosed. When examining year-over-year data, the percentage of patients remaining at their diagnosing facility for all treatments has steadily increased from 48 percent in 2017 to 52 percent in 2021.

Conversely, just 9 percent of oncology patients chose to leave the facility where they were diagnosed to receive all treatments elsewhere. The percentage of patients receiving all treatments from external facilities has held fairly steady, seeing a slight decrease from nine percent in 2017 and 2018 to eight percent in 2019; it has consistently remained at eight percent through 2021. This finding, when examined alongside the growing trend of more patients remaining at their diagnosing facility, suggests that fewer oncology patients are leaving their primary facility to receive care elsewhere.

49% of oncology patients chose to receive all treatments at the same facility where they were diagnosed.

Treatment times

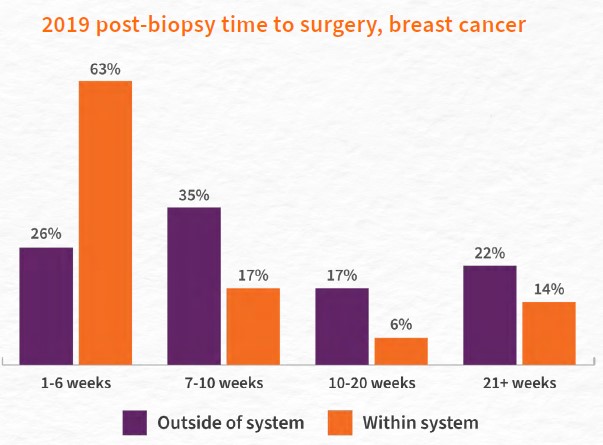

Data showed that patients who stayed within their diagnosing facility post-biopsy were more likely to receive surgery sooner than patients who obtained treatment outside of their diagnosing facility. In 2019, 63 percent of breast cancer patients who stayed within their diagnosing health system received surgery within six weeks post-biopsy, compared to just 26 percent of patients who received surgery outside the diagnosing health system. Patients receiving radiation outside of the health system were more likely to receive this treatment within seven to 20 weeks (52 percent) than patients receiving radiation within the health system (23 percent).

This same pattern emerged when examining data for breast cancer patients who required chemotherapy after surgery. In 2019, nearly half of patients (49 percent) who remained within their diagnosing facility for chemotherapy received treatment within one to six weeks post-surgery, while just over a third of patients (35 percent) who sought chemotherapy outside of the diagnosing facility received treatment within this time.

While the timing of when breast cancer patients receive treatment may vary for a variety of reasons, studies have linked treatment times to outcomes among breast cancer patients. One study noted that a time of greater than 90 days from diagnosis to surgery can negatively impact outcomes, while another study found that chemotherapy delayed beyond 12 weeks after surgery can adversely affect clinical outcomes. With this in mind, the fact that patients typically receive treatment sooner when remaining within the same site as their diagnosing facility suggests a major benefit of this approach.

Patients who stayed within their diagnosing facility post-biopsy were more likely to receive surgery sooner than patients who obtained treatment outside of their diagnosing facility.

Migration volumes by treatment type

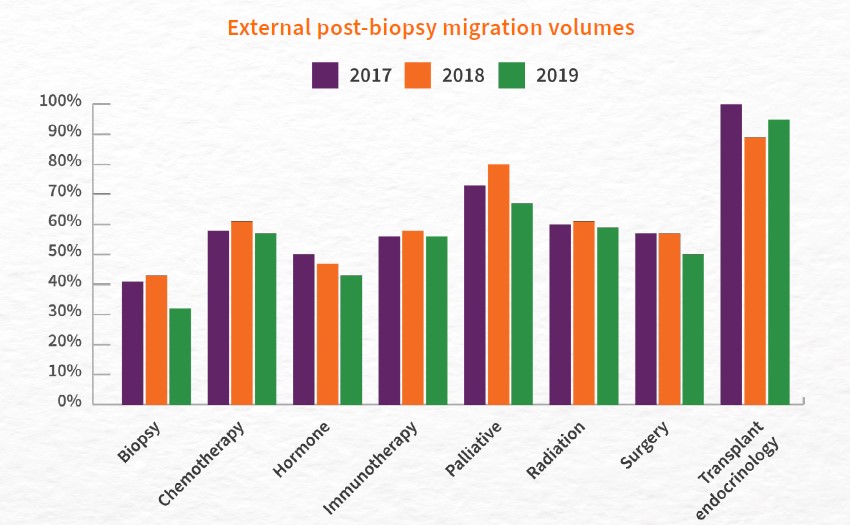

Procedure-level data provide crucial insights into site-of-care setting patterns, enabling providers to understand not only how many patients are receiving care from external facilities but also the procedures they are most likely to receive externally and how these patterns change over time. Armed with this information, providers and hospital leaders will be well-equipped to make informed decisions about the care settings and services they offer.

When looking at treatments patients seek externally, a review of post-biopsy migration data from 2017 to 2019 showed that for nearly all types of cancer treatments, a majority of patients sought care outside of their primary facility post-biopsy. More than half of patients sought treatment externally for chemotherapy, immunotherapy, palliative care, radiation therapy, surgery, and transplant endocrinology. Patients were least likely to seek external care for biopsies and hormone therapy: an average of 39 percent of patients obtained biopsies externally, and an average of 47 percent of patients obtained hormone therapy externally. Patients were most likely to seek external care for transplant endocrinology (obtained externally by an average of 95 percent of patients).

Some procedures saw gradual declines in external care, which may suggest that more patients are seeking these treatments from their diagnosing facility. External biopsies declined from 41 percent in 2017 to 32 percent in 2019. External hormone treatments dropped from 50 percent in 2017 to 43 percent in 2019. External surgeries also declined, from 57 percent in 2017 and 2018 to 50 percent in 2019.

For all other procedures shown, these figures did not significantly change over this three-year period, indicating that patient interest in external care has held steady during this time.

What to consider for future planning

Invest in clinical data

Because data can help hospital staff detect shift patterns and determine appropriate care settings for patients, having the right tools and resources to access and analyze clinical data across care settings is paramount. Partnering with a third party for clinical data management services helps health systems ensure high data integrity and allows clinical staff to focus on patient care.

Evaluate hospital spending

Given the effects of these shifts on hospitals’ bottom lines, hospital leaders should take a close look at their spending and consider where it makes sense to cut costs. Conducting an assessment—a focused analysis to identify hospital costs and areas to align operations, reduce costs, and focus on high-value activities—can help hospitals maximize their resources.

Look for improvements in reporting processes

For many service lines and registries, the need for hospitals to collect and report quality clinical data will not change. When streamlining operations, hospital leaders should empower staff to find new ways to improve existing registry reporting processes. This may include working across departments to update staff on changing guidelines or holding focus groups with clinical teams to brainstorm new improvements.

Build a larger presence in outpatient care

By partnering with ambulatory care sites or building outpatient sites themselves, hospitals can grow their involvement in outpatient care while continuing to serve patients’ needs. According to a McKinsey survey, 41 percent of healthcare providers are building outpatient facilities to prepare for a shift to outpatient sites of care.

Consider new partnerships thoughtfully

Partnering with existing ASCs is a common approach for hospitals interested in expanding their outpatient care reach. As with any strategic decision, due diligence is key. Some factors to consider when evaluating ASCs as potential partners include operating expenses, patient satisfaction, lease terms and obligations, payment rates, ongoing and historic caseload, costs of performing specific procedures, and ASC coding practices.

Conclusion

While the changing healthcare landscape brings challenges for hospital leaders to navigate, it brings new opportunities as well. Patients can benefit from lower costs, shorter recovery times, and fewer complications—and, with some planning, hospital leaders can streamline operations and meet patients’ needs on the new frontier.

To contend with services shifting to outpatient care, hospital leaders should harness the power of clinical data, which offer valuable insights into the services and procedures patients are receiving outside of the hospital setting. This information can be used to guide decisions about where providers should focus their efforts to best serve patients and ensure the continued success of their facility.

Meanwhile, in areas where shifts are not expected—such as collecting and reporting clinical data for registries—hospital staff can take stock of their processes and consider ways to implement improvements and efficiencies. After developing a plan for moving forward, hospital leaders will be better equipped to provide patients with quality care in the setting most suitable for their needs.